40+ how to claim mortgage interest on taxes

Web The 1098 is in someone elses name not a seller-financed loan but you pay some or all of the mortgageinterest. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

The Home Mortgage Interest Deduction Lendingtree

Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098.

. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web Your lending servicer will provide you with a copy of Tax Form 1098 Mortgage Interest Statement detailing how much youve paid in mortgage interest. Web You can deduct the interest on your mortgage on up to 1 million dollars of your home mortgage debt or up to 500000 if youre married and filing separately.

Both of you should attach a. If they are incurred for the purpose of earning income by renting property to tenants the. Web How to Claim Your Deduction Eligible homeowners can claim the mortgage interest tax deduction on Schedule A of their annual tax returns.

You filed an IRS form 1040 and itemized your deductions. Web Aaron is a single taxpayer who purchased his home with a 500000 mortgage. Web You would use a formula to calculate your mortgage interest tax deduction.

Look in your mailbox for Form 1098. Ad File 1040ez Free today for a faster refund. Taxes Can Be Complex.

Web How you claim the Mortgage Interest Deduction on your tax return depends on the way the property was used. Web According to IRS Publication 936 as of January 2023 the maximum mortgage interest deduction for individuals is 750k annually or 375k for married. Web Mortgages can be considered money loans that are specific to property.

Filing your taxes just became easier. Web For example a homeowner with an MCC in Louisiana -- which allows 40 of mortgage interest as a credit -- who paid 10000 in mortgage interest in 2022 could. Ad Easy Software To Help You Find All the Tax Deductions You Deserve.

For mortgages taken out after. My daughter fell into some financial troubles so I paid her mortgage. Start basic federal filing for free.

The table above shows that if youre single. Web Form 1098 is the statement your lender sends you to let you know how much mortgage interest you paid during the year and if you purchased your home in the. Ad Claim Your Credits And Deductions To Help You Maximize Your Tax Refund.

However due to the Tax Cuts and Jobs Act the amount you can claim may be reduced. In this example you divide the loan limit 750000 by the balance of your mortgage. Web Enter your mortgage interest costs on lines 8 through 8c of Schedule A then transfer the total from Schedule A to line 12 of the 2021 Form 1040.

Web Is it legal for my daughter to claim mortgage interest deduction and property tax deduction if I paid them. Ad Claim Your Credits And Deductions To Help You Maximize Your Tax Refund. Web In order to itemize your return you would need to have itemized deductions greater than your standard deduction which is 25900 for a couple filing a joint return.

He paid 19100 in mortgage interest in 2022 as shown on his 1098 form. Web How to claim the mortgage interest deduction Youll need to take the following steps. If the Mortgage Interest is for your main home you would enter the.

Web You can claim your Mortgage Interest on your home. In most cases youd have to be the owner of the property to take. Homeowners who are married but filing.

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web Based on first-year interest costs for a 30-year fixed-rate mortgage at the current national average rate of 365. Ad Over 90 million taxes filed with TaxAct.

Your mortgage lender sends you. File your taxes stress-free online with TaxAct. Web If each taxpayer paid one-half of the mortgage and real estate tax expenses then each Schedule A should reflect one-half as deductions.

Web To qualify for a home mortgage interest tax deduction homeowners must meet these two requirements. Taxes Can Be Complex.

Mortgage Interest Relief Restriction Mercer Hole

Mortgage Interest Deduction Bankrate

Costs Of Owning A Home In 2022 Scott Westfall Cgp Real Estate Newsbreak Original

Mortgage Interest Deduction A 2022 Guide Credible

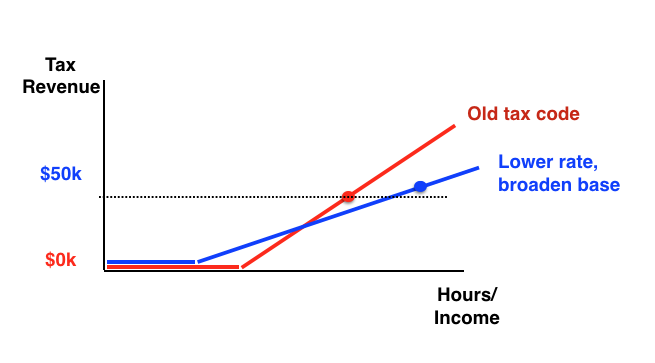

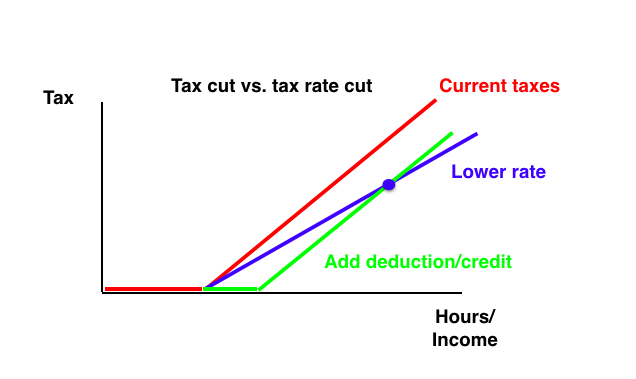

More Roth Vs Traditional 401k Ira Data Historical Marginal Tax Rates Vs Median Income My Money Blog

The Home Mortgage Interest Deduction Lendingtree

Business Succession Planning And Exit Strategies For The Closely Held

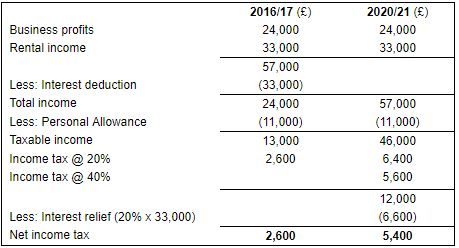

Section 24 Landlord Tax Expert Insights On Phase 2

Maximising Property Tax Deductions For The 2020 21

10 Year Treasury Yield Hit 1 21 More Than Doubling Since Aug But Mortgage Rates Near Record Low And Junk Bond Yields Dropped To New Record Lows Wolf Street

Section 80e Income Tax Benefits On Education Loan With Sec 80e

When Will I Get My Tax Refund Kwkt Fox 44

Worthwhile Canadian Initiative The Basic Arithmetic Of Rrsps And Tfsas

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

How Do I Claim The Mortgage Interest Deduction

Tax Graph Seeking Alpha

Tax Graph Seeking Alpha